Calibration of Hestons Stochastic Volatility Model

Since the ground-breaking work of Black, Scholes [2] and Merton

[4] the development of financial market models has gone a long way. Nowadays

quite sophisticated models are employed in the financial market industry to price

and hedge options. But before the models can be applied in practice, one has to

implicitely identify the unknown model parameters from given market data. Usually,

as an industry standard, a set of standard option prices serves as an appropriate set

of market data. A good model must hence be able to provide a suitable fit of this

so-called volatility surface.

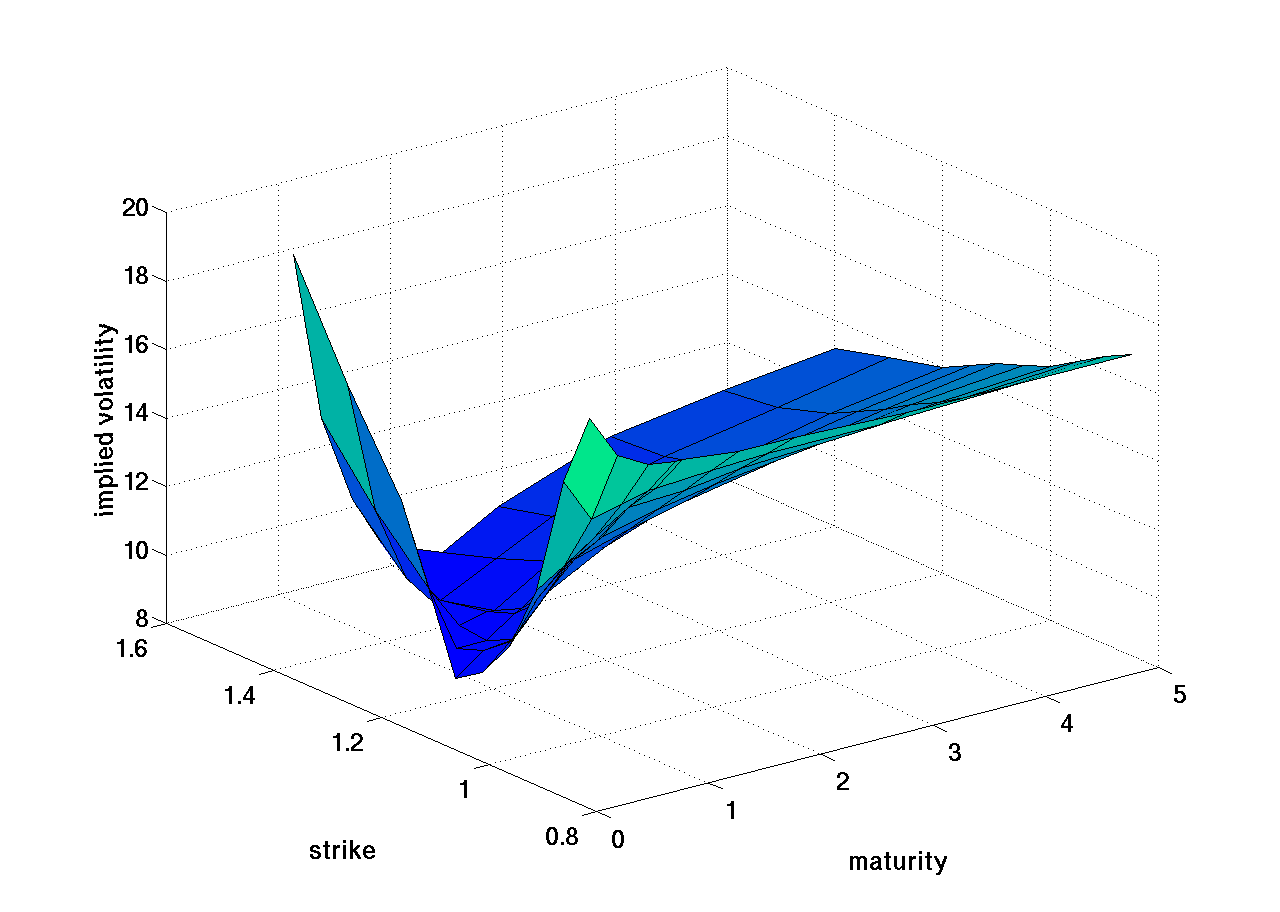

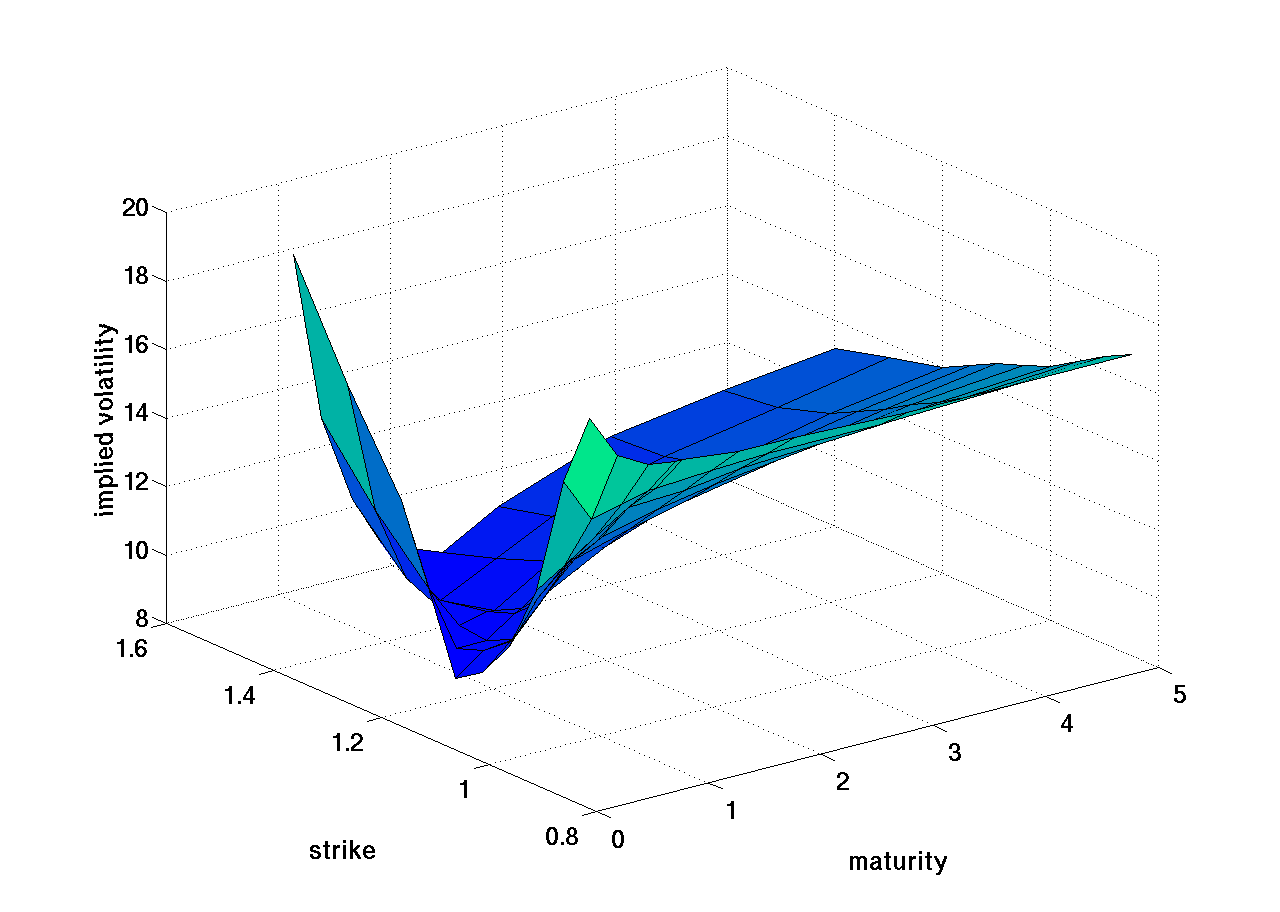

Fig.: Implied Volatility Surface [1] Fig.: Implied Volatility Surface [1]

In a joint research project, the University of Trier

developed an algorithm for the identification of the underlying parameters of Hestons

stochastic volatility model [3].

Publications:

Gerlich,F., Giese,A.M., Maruhn,J.H., Sachs,E.W., Parameter Identification in Stochastic Volatility Models with Time-Dependent Model Parameters

submitted, 2006

Literature:

[1] L. Andersen and R. Brotherton-Ratcliffe. The equity option volatility smile: an implicit

finite-difference approach.

The Journal of Computational Finance, 1(2):5–38, 1997/1998.

[2] Black, F., Scholes, M. The pricing of options and corporate liabilities.

Journal of Political Economy, Vol. 81, pp. 637-659, 1973.

[3] Heston, S. L. A Closed-Form Solution for Options with Stochastic Volatility with Applications

to Bond and Currency Options.

The Review of Financial Studies, Volume 6, number 2, pp. 327-343, 1993.

[4] Merton, R. C.: Theory of rational option pricing.

Bell J. Econom. Manag. Sci. 4, pp. 141-183.

Webmaster Webmaster |

|

|

|

|

|

FB 4 - Department of Mathematics |

|

University of Trier |

|

|

|

|

|

|

WAP-Homepage: http://www.mathematik.uni-trier.de/wap/ |

|

Fig.: Implied Volatility Surface [1]

Fig.: Implied Volatility Surface [1]